Debt to income ratio calculator for heloc

For PenFed the maximum DTI may go. Find a Card With Features You Want.

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

The maximum debt to income DTI varies for each lender.

. Considering a HELOC on primary residence for further real estate investment purposeswould. You earn 6000 per month before taxes and your total monthly debt is 2160. The Debt to Income Ratio Calculator is a very useful financial calculator that will allow you to input your monthly debt and your monthly income and provide you with a debt to income ratio.

Dont Wait For A Stimulus From Congress Refi Before Rates Rise. The minimum credit score for a HELOC is 660. For example the most common guideline for debt-to-income ratios is 33 percent income to 38 percent debt Best Place To Get A Heloc Loan As house prices continue to rise.

Apply Online Get Pre Approved In 24hrs. Ad Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent.

For instance lets say you have 1000 in reoccurring monthly. This is the percentage of your gross income required to cover your housing and debt. Another number many lenders consider before they decide you qualify for a HELOC is your debt-to-income ratio or DTI.

Compare Save With LendingTree. See if Youre Pre-Approved. Divide 2160 by 6000 and you will get 36 percent your DTI ratio.

If you take 150000. Assume you make 6000 each month before taxes. Check to see if you qualify for a HELOC today.

Ad Work with One of Our Specialists to Save You More Money Today. Posted Jun 25 2015 0740. For example suppose you owed 150000 on a home with a current appraised value of 500000.

Ad Give us a call to find out more. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. Now lets assume that your monthly payment towards your debts plus the expected monthly payment of your HEL is 2160.

The lower the DTI. Let us help you get a loan. LTV Current loan balance Current appraised value of property x 100.

Justin Hennig Pro. Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements. Use our easy 60 second qualifier to maximize your benefit.

Debt to Income for a HELOC. The optimal debt-to-income ratio for HELOC eligibility is around 36 but each case is unique. Ad Give us a call to find out more.

Use this calculator to quickly determine your debt-to-income ratio. The lower your DTI ratio is the better chance you have of qualifying for. Ad Best HELOC Loans Compared Reviewed.

Ad We have 20 years of experience helping you use your benefit. Your debt-to-income ratio is the total of all your monthly debt. Your debt-to-income ratio is simply your total monthly debt divided by your total monthly income.

The calculation is actually quite simple. Ad Put Your Equity To Work. Ad Get More From Your Home Equity Line Of Credit.

Take your total reoccurring monthly debt and divide it by your gross monthly income.

Looking For A Heloc Calculator

What Is The Debt To Income Ratio Learn More Citizens Bank

How To Calculate Debt To Income Ratio

Heloc Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

What Is Debt To Income Ratio Dti And Why Does It Matter Nextadvisor With Time

![]()

Home Equity Line Of Credit Calculator Heloc Qualifier

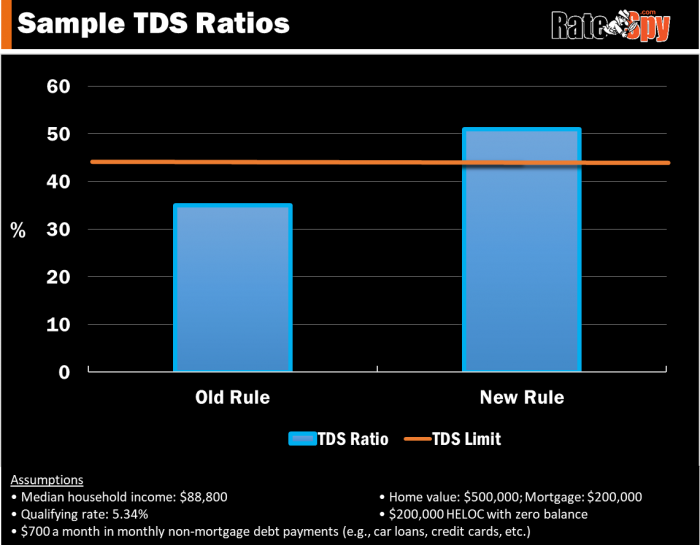

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

Debt To Income Ratio Calculator Canada Debt Ca

How To Calculate Debt To Income Ratio

Home Equity Line Of Credit Qualification Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Calculator Lovetoknow

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans